Keeping overtime to a minimum can help reduce labor costs. Monthly rate of pay26 days Section 60I 1A EA.

Your Step By Step Correct Guide To Calculating Overtime Pay

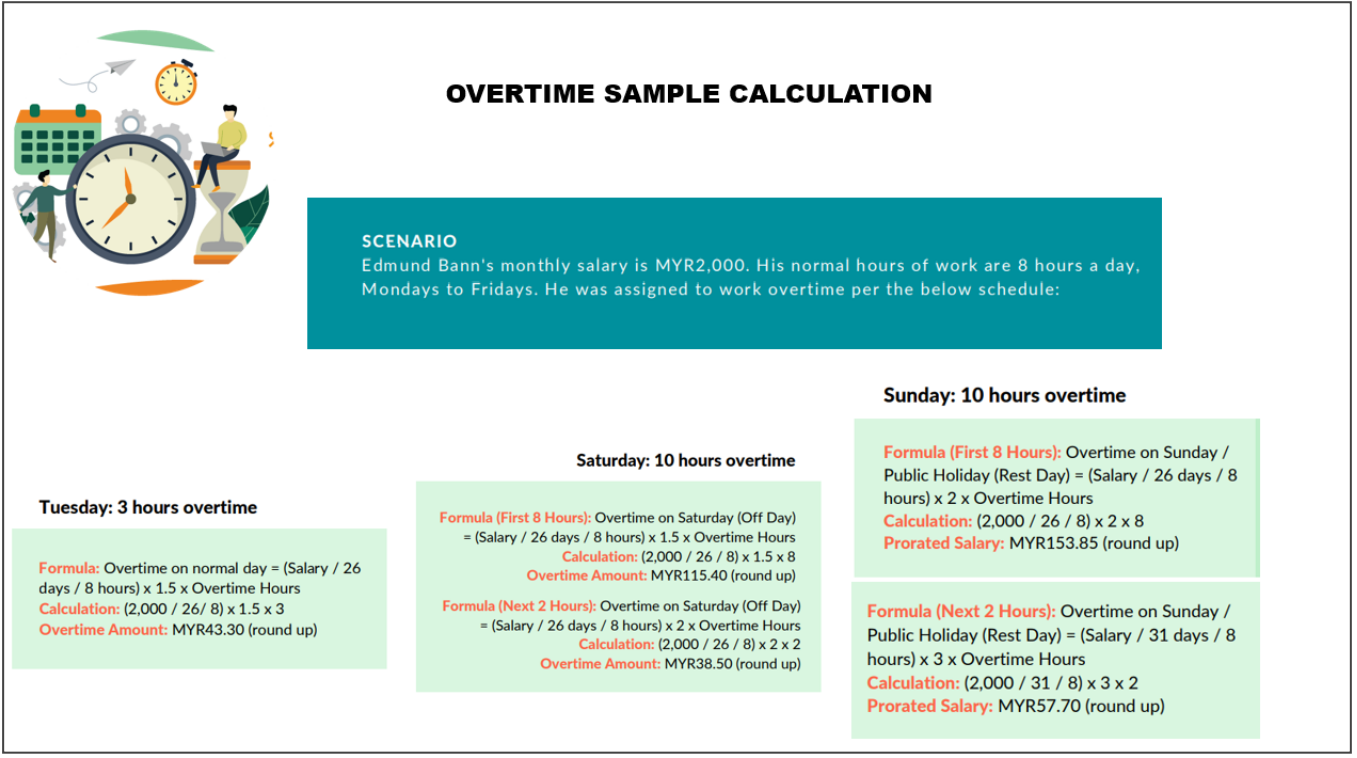

Of work days in the relevant month So when an employee works 8 hours a day for a monthly salary of RM2600 heshe will have an ordinary rate of pay of RM100 Monthly salary 26 RM2600 26 RM100.

. For work on a rest day the pay shall be no less than 20 times the hourly rate and on a public holiday no less than 30 times the hourly rate. However you can avoid employees working overtime with careful management and scheduling. For employees with salary not exceeding RM2000 a month or those falling within the First Schedule of Employment Act 1955 the laws in respect are spelled out in the Employment Act 1955.

Then calculate the overtime rate. Employee who works overtime on rest day not exceeding half hisher normal hours of work. Then calculate the overtime pay rate by multiplying the hourly rate by 15 and then multiply that figure with the number of overtime hours worked.

Monthly rate of pay No. 20 per hour x 15 OT rate 30 per hour. In the system the daily rate of pay is divided by 8.

05 x ordinary rate of pay half-days pay ii. For any overtime work carried out in excess of the normal hours of work EA Employees are to be paid at a rate not less than 15 times hisher hourly rate of pay HRP irrespective of the. It is applicable to shift employees where they work for a specific period of time.

Blended overtime is the pay an employee who works at two or more pay rates receives for working more than 40 hours in a given 7 day period. Career Resources - Overtime is part of work life. Rest day follow normal working hours.

Of course overtime work has a limit. 05 x ordinary rate of pay half-days pay More than half but up to eight 8 hours of work-. For holiday you should pay employee at rate 20 X for the first 8 working hours.

The Employment Limitation of Overtime Work Regulations 1980 grants that the limit of overtime work shall be a total of 104 hours in any 1 month. More than half but up to eight 8 hours of work-10 x ordinary rate of pay one days pay iii. This is applicable for employee overtime pay in Malaysia regardless of the salary being calculated by daily rate or monthly basis.

Where work does not exceed half his normal hours of work. Working on Off-day 20 Basic pay 26 days X 20 X hour of works. The Employment Limitation of Overtime Work Regulations 1980 provides that the limit of overtime work shall be a total of 104 hours in any 1 month.

If they work more than 8 hours on public holiday you need to pay them at rate 30 x for the balance overtime working hours. First calculate the daily ordinary rate of pay by dividing the monthly salary by 26. Despite the pay rate shall be 1 ½ times the hourly rate of pay of employees some employers found it rather economical to required employees to.

30 per hour x 10 hours 300. This means an average of about 4 hours in 1 day. ½ the ordinary rate of pay for work done on.

Product - Access Control System - - Door Access - - Face Recognition - - Fingerprint. Payslip Template for Payroll Malaysia. How OT hours are calculated based on Seksyen 60 3 Seksyen 60 1 Employment Act 1955.

Here this would be RM625 x 15 x 2 hours RM1875. Divide the employees daily salary by the number of normal working hours per day. 15x hourly rate of pay.

Employee work 10 hours on rest day. Overtime Calculator for Payroll Malaysia - Payroll Process 1. Even though the pay rate is 1 ½ time the hourly rate of employee pay some employers found it rather economical to.

Normal working day 15 Basic pay 26 days X 15 X hour of works. The Employment Act provides that the minimum daily rate of pay for overtime calculations should be. In excess of eight 8 hours-20 x hourly rate x number of hours in excess of 8 hours.

Then divide the ordinary rate by the number of normal work. For employees paid on a monthly basis overtime entitlements under the Employment Act are as follows. Employees who regardless of monthly wage are engaged in.

Basic pay 26 days X 30 X hour of works. Malaysia Epf Calculator For Payroll System - Payroll Process 2. Working on Public Holiday.

For employees who get paid on a monthly basis the hourly rate could be obtained by dividing the monthly salary by 25 or 26 days then divided by the amount of hours per normal working day. The ordinary rate of pay on a monthly basis shall be calculated according to the following formula. And similar to salary and other mandatory benefits overtime pay.

Employees who earn monthly wages of RM2000 or less. Overtime on rest day. However the Act only covers a number of select employee categories in Malaysia.

Section 2 1 defined wages as means basic wages and all other payments in cash payable to an employee for work done in respect of his contract of service but does not include. Finally add the regular pay with the overtime pay. 20 x hourly rate x number of hours in excess of 8 hours.

As much as we wish we could reduce the costs of taxes that is something we have little control over. Salary Calculator Malaysia for Payroll System - Payroll Process 3. This is applicable whether the employees are paid on a daily rate or on a monthly basis.

As per Employment Act 1955 Malaysia the employee shall be paid at a rate not less than 15 times hisher hourly rate for overtime work in excess of the normal work hours. 10 x ordinary rate of pay one days pay In excess of eight 8 hours-. When an employee receives a monthly rate of pay the ordinary rate of pay should calculate accordingly.

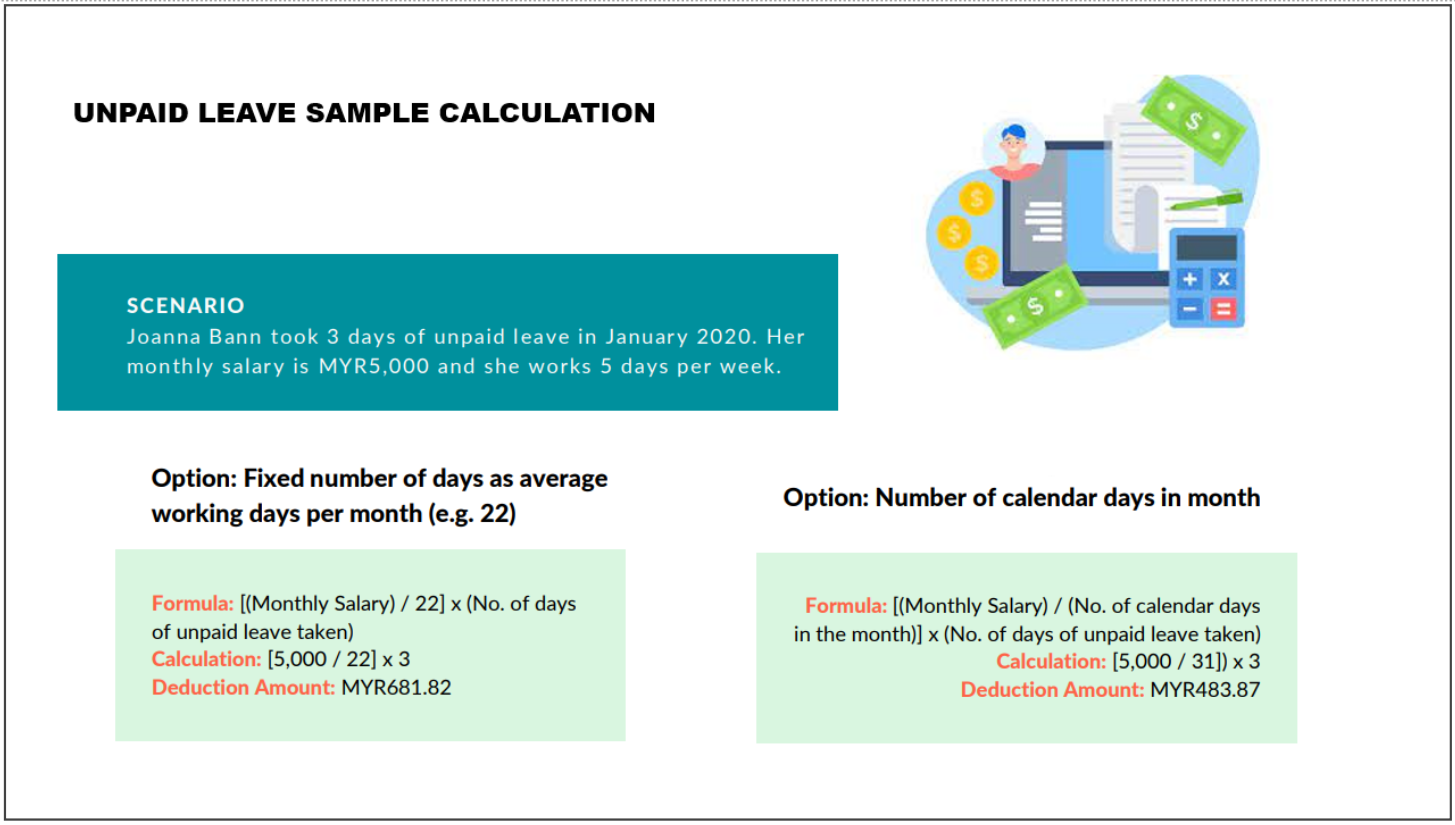

However employers are also allowed to choose any other calculation basis which is more favourable to the employee eg monthly wages22 if the employee works 5 days a week. RM50 8 hours RM625. RM1200 per month 26 days RM577 per hour X 2 RM5769 per day.

Next calculate Joes overtime pay. For normal working days an employee should be paid at a rate of 15 times their hourly rate for overtime work. According to the Employment Act 1955 employers are required to payout monthly wages on the seventh day of the following month or earlier.

Working in excess of normal working hours on a normal work day. This means an average of 4 hours in 1 day. - Payroll Process 4.

In Malaysia the Employment Act 1955 defines overtime as the number of hours of work done beyond the normal working hours daily. The law on overtime. For employees whose salary exceed RM2000 a month the hours of work and overtime work depend on the terms agreed under their employment contracts.

Everything You Need To Know About Running Payroll In Malaysia

Your Step By Step Correct Guide To Calculating Overtime Pay

Calculate Overtime In Excel Google Sheets Automate Excel

Jasmeen Is Working At Regal Haven Sdn Bhd With A Monthly Basic Course Hero

Your Step By Step Correct Guide To Calculating Overtime Pay

Your Step By Step Correct Guide To Calculating Overtime Pay

Overtime Calculator For Payroll Malaysia Smart Touch Technology

How To Calculate Overtime Pay For Employees In Malaysia Althr Blog

Easy Steps On Calculating Your Overtime Pay Free Downloadable Sheet Career Resources

Overtime Calculator For Payroll Malaysia Smart Touch Technology

Everything You Need To Know About Running Payroll In Malaysia

Your Step By Step Correct Guide To Calculating Overtime Pay

Excel Formula Timesheet Overtime Calculation Formula Exceljet

How To Quickly Calculate The Overtime And Payment In Excel

How To Calculate Overtime For Salary Employees In Malaysia Madalynngwf

Excel Timesheet Calculator Template For 2022 Free Download

Excel Formula Basic Overtime Calculation Formula

Excel Timesheet Calculator Template For 2022 Free Download

Your Step By Step Correct Guide To Calculating Overtime Pay